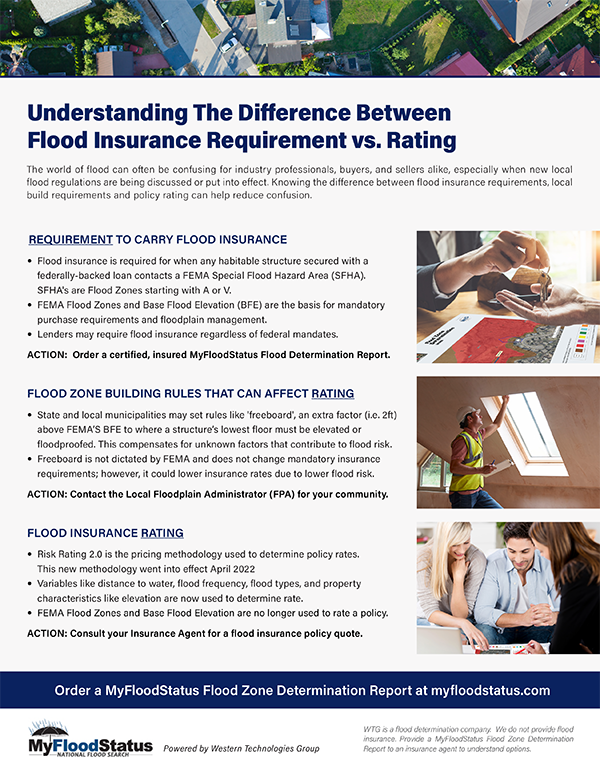

Understanding the Difference Between Flood Insurance Requirements vs Rating

Starting April 1, 2022, all National Flood Insurance Program (NFIP) policies will be priced under Risk Rating 2.0 upon their next renewal.

The new Risk Rating 2.0 pricing methodology for calculating flood insurance rates has caused some confusion for homeowners and real estate agents, but we think everyone can benefit from understanding the difference between flood insurance requirements and flood insurance rates.

Mandatory flood insurance requirements and flood insurance rating are two separate things. RR2.0 affects rating, not requirement.

Read on to gain clarity on requirement vs rating, why this matters when buying, selling or insuring a home, and how MyFloodStatus can help you confirm or challenge flood insurance requirements.

Flood Insurance Requirements

Flood insurance requirement is dictated by FEMA Flood Zones and Base Flood Elevation.

As FEMA simply puts it, flood insurance is required on “Homes and businesses in high-risk flood areas with mortgages from government-backed lenders”. But, to be more specific: Flood insurance is required when a habitable structure is within or touches a Special Flood Hazard Area (SFHA) if that structure has been secured with a loan from a federally regulated lending institution.

SFHA’s are the high-risk zones FEMA speaks of, and they are Zones that begin with A or V designated on FEMA flood maps or Flood Insurance Rate Maps (FIRMs).

Free 1-Page Guide

Download our free 1-page guide, “Understanding The Differences Between Flood Insurance Requirements vs. Rating”, for your own reference, or to educate others.

Flood Insurance Rates (Under Risk Rating 2.0)

The ultimate goal of RR2.0 is to attribute more accurate insurance rates to policyholders nationwide. When a structure is in an SFHA, thereby requiring flood insurance, Risk Rating 2.0 is the new pricing methodology insurance companies must use.

However, this new pricing methodology is causing some confusion because RR2.0 now determines rates based on new, expanded variables such as:

Distance to flooding source

Foundation Type

Ground Elevation

Building Occupancy

Prior Claims

Cost to Rebuild

And more

Two variables NOT utilized under RR2.0 include FEMA Flood Zones and Base Flood Elevation (BFE). Because of this, people are inaccurately stating FEMA Flood Zones are going away and Elevation Certificates no longer matter, however, this is incorrect.

As stated above, the FEMA Flood Zones and BFE will continue to be the two variables used to determine the requirement of mandatory flood insurance. They will also continue to be the basis for challenging the requirement of flood insurance and for floodplain management.

Additionally, it’s important to know that all lenders retain the prerogative to require flood insurance, regardless of federal mandates, in order to protect the collateral securing the loan. Lenders may still impose a flood insurance requirement based on the presence of risk, and clients may challenge a flood zone status for potential removal of the requirement altogether with the aid of our reports and services.

How to Confirm or Challenge Official Flood Status

The process of confirming or challenging an official flood zone status always starts with securing a MyFloodStaus certified, official structure-based flood zone determination report. Our pinpoint accurate data and expert guidance are what help individuals understand the exact flood status of a structure, and whether any potential avenues exist for challenging, and removing, the requirement.

In contrast, free online resources are not official, certified determinations, and typically lack detail and clarity, and can further complicate your attempts to obtain clear, reliable flood zone information on a structure. Relying on free websites and generic, disclaimered maps will not give you the official documentation needed to have flood insurance requirements removed.

Get started today by ordering your own report on any property nationwide directly through our website. For guidance, check out “How to Order from MyFloodStatus” or Contact Us.

MyFloodStatus is a flood zone determination company. We do not provide flood insurance. Please consult with a flood insurance agent to understand flood insurance premium options. The information provided is for informative purposes only and is not intended to be legal advice or a legal opinion. For legal advice, please consult an attorney.

Resources

https://www.fema.gov/flood-insurance/risk-rating

https://www.fema.gov/flood-insurance

https://fas.org/sgp/crs/homesec/R45999.pdf

https://www.fema.gov/sites/default/files/documents/fema_rr-2.0-equity-action_0.pdf